Sustainability in Agriculture

April 22, 2025

Harnessing Genetic Engineering for Enhanced Plant Virus Resistance

April 22, 2025Assessing Agri Drone Viability in India: Economics & Growth

First, let’s set the scene: India ranks 2nd in terms of arable land globally, with nearly 50% of its land dedicated to crops, totaling 160 million hectares. Breakdown of land ownership and size is as follows:

Less than 2 hectares: 47.3% ownership, covering 75 million hectares

Between 2 to 10 hectares: 43.6% ownership, covering 69.7 million hectares

More than 10 hectares: 9.1% ownership, covering 14.5 million hectares

Approximately 90% of Indian farmers own between 0.5 to 10 hectares of land. Drones in agriculture primarily serve for pesticide spraying, alongside soil analysis, precision farming, and crop monitoring, though these latter applications are still in their infancy stages in India.

To delve into the use case of drones on farmland, there are two primary scenarios for crop spraying:

- Human-led spraying: Done manually in areas where machines cannot access.

- Machinery-based spraying: This includes using a combination of tractor, boom, and sprayer or standalone sprayers like drones.

Barring high end/high value crops, like grapes and pomegranate for which farmers own the sprayers and unit economics work differently; the ideal use case of conventional sprayers in a leasing model is applicable to crops like cotton, sugarcane, paddy where crop economics do not favor for the farmer to own the asset.

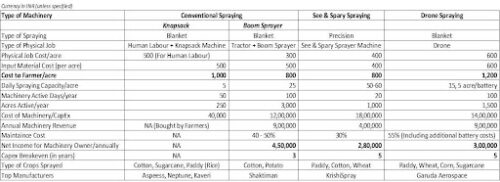

Let’s now understand the unit economics in a farm leasing model for input spraying use case: Below is a table for a brief understating followed by a detailed explanation –

- Conventional Spraying (Knapsack or Boom Spraying) – Blanket Spraying Method:

Knapsack: Can cover approximately 5 acres/day with a labor charge of 500-600 INR/hour and an additional input cost borne by the farmer which is 500 INR/acre. The overall leasing cost for the farmer comes around 1000 INR/acre.

The cost of buying the Knapsack erstwhile is 35,000 – 40,000 INR

Boom Sprayer: Here the spraying volume increases by 300-400%, considering the Tallboy model of Shaktiman (the manufacturing company), it does around 25-30 acres/day of spraying. This is attached behind the tractor for spraying.

This is usually for crops like Cotton, Potato where one season lasts for around 6 months it used for 5-6 times (number of times to be sprayed). And the machine is active for 100 days in a year and targets 2,500 – 3,000 sprays per year (100 days x 25 acres/day).

The farmer is charged 250 – 300 INR/acre. The input cost would be 500 INR/acre (same as Knapsack method. So, the overall cost of leasing a Boom sprayer for the farmer per acre would be = 300 INR (Boom Sprayer) + 500 INR (input cost) = 800 INR/acre

This type of spraying completely operates in the VLE (Village Level Entrepreneur) leasing model where the entrepreneur buys the sprayer and then earns on basis of usage of the machine. The cost of buying (CapEx) a Boom sprayer is 12 – 14L INR. The maintenance cost plus cost of finance is roughly 120 INR/acre (40%) on the revenue of 300 INR/acre for the VLE.

So, on average the VLE earns –

300 INR/acre x 3,000 acres = 9L INR/year. Takes home 50% (on average) after expenses = 4.5L INR so the VLE breaks even the capex/machinery cost in 3 years. In rural India, ideally breaking even on a farm machinery in a 2.5 – 3 years is considered a good business where people want to deploy more money.

Boom spraying is still in the nascent stage of commercialization in India and from market knowledge not more that 10,000 units have been sold and this is active in India for 2-3 years now. UPL has been a key input player promoting this type through their investment in nurture farm and Shaktiman is the only company building and operating in this space as a key manufacturing player.

- See & Spray Spraying – Precision Spraying Method:

The working is same as Boom sprayer, i.e., self-propellent sprayer although much more efficient through precision spraying. The helps the farmer to save 40-50% on the input cost. This is mostly used in cotton crop lands and farmers who have 30 – 50 acres of crop land holding on average.

The cost to the farmer is 400 INR/acre to use the See & Spray in the leasing model. The input cost comes down by 50% so now it is 400 INR/acre (usually in the input for cotton is 800 INR/acre).

So, per acre the farmer spends 400 INR/acre (machinery) + 400 INR/acre (input cost) = 800 INR/acre.

The catch here is that there is a new business model from the VLE within the usage of this machinery: the VLE goes to the farmer and asks what type of input does he need because farmer is more concerned about the spray. So instead of passing the entire 50% input cost to the farmer, the VLE shows a cost benefit of 200 INR, charges the farmer INR 600 and pockets the remaining 50% pie (INR 200). And this model is getting relevant among the agri input retailers who are best positioned to take this benefit and act as VLE.

The cost of the See & Spray machine is 18L INR. The owner sprays 60 acres per day, on a yearly basis 800 – 1,000 acres of spraying per machine. On per acre revenue of 400 INR, the cost of repair and maintenance 125 INR/acre. So the farmer on yearly basis makes –

(1000 acres x 400 INR/acre Revenue = 4,00,000 INR) – (1000 acres x 125 INR/acre Revenue = 1,25,000 INR) = 2,75,000 INR of take home profit. And the breakeven for this capex would be 5 – 6 years (This does not consider the new model where the VLE is making revenue a pie from input material cost arbitrage).

- Drone Spraying – Blanket Spraying Method:

Here the cost of spraying (just using the drone as a service) for the farmer is 600 INR/acre. The input cost is same 600 – 800 INR/acre.

So, the input spend is: 600 INR (drone) + 600 INR (input) = 1,200 INR/acre for the farmer.

The drone cost is 12L – 14L, the average spraying capability is 50 litre per charge, one battery can do 1 cycle in a day (one charging lasts 40 min of usage – it is difficult to spray for the entire 40 min at once because it only happens in a one stretch of land), 1-2 spare battery cycle is also kept on the standby; and in a day one battery will cover 3 acres of spraying.

On a yearly basis it will be active for 100 days covering 500 acres (100 days x 5 acre/day) per battery so the drone owner has to keep 3 batteries in total at any point of time to cover 1,500 acres annually or 15 acres/day. The total revenue would be –

1,500 acres x 600 INR/acre = 9,00,000 INR. The R&M cost would be 40% so the take home for the owner is around 5L INR. Keeping backup batteries for better spraying efficiency, the ROI payback period will increase significantly.

The additional battery costs is around 15% of the cost and needs to be replaced after every 400 -500 cycles of usage. Being operational for 100 days, so one battery will do 100 cycles in a year.

So, that would net to 5L minus 2L (additional battery) = 3L net revenue/year and the break would be in 5 years for the drone owner.

As a higher usage cost for the farmer and also an elongated breakeven time for the drone owner, the usability of drone still has many dots to join to make it a unit economics viable model. Battery is the biggest issue at the moment and developing form factor enhancement (currently 4-5 years) should be the key innovation among the drone manufacturing industry.

One of the way drones are being tested out is that farmers are being subsidized on the input, for 1,000 INR spend, they are being given a subsidy of 200 INR from the input manufacturer/OEM and asked to use the drone service to negate the extra machinery costs to the substitutes discussed above.

Agri sector is still 40% unorganized for Input materials (this is a debatable data), the drone penetration is tested and experimented by organized/OEM input manufacturers to gain and retain on the uncaptured market share by the unorganized input players.

The best use case of using drones is that it saves a lot of water. For example, for 100L of pesticide spraying, it requires 100L of water usage. In the most in Conventional method – 1:1 ratio, 1:5 for See & Spray and 1:10 for Drone, i.e., for spraying 10L of pesticide only 1L of water is used.

Considering all above aspects of spraying, it is important to conclude and understand that land pattern cannot be combined with crop pattern, i.e., high value crops being produced only with farmers with land holding greater than 2 hectares is not necessary. While also opting for the right spraying model to the type of crop grown and the size of the land, to the efficiency requirement needs to be considered.

The most important aspect to consider for any of these model is the need to the availability of the machine in that hour.

Few Points to Elaborate more on:

A} Many of the crop, traditional methods has limited reach. Excess water dilution resulting lower efficacy.

B} Most of the chemical per acre dosage is not in litre but in ml, so 8 litre per acre of water including prescribed chemical dosage is SOP of India, globally some are following 15.5 litre per hectare {Water+Chemical combined}.

C} Selection of nozzles greatly effect the efficacy of chemicals on right crops. Or else, its just lifting by drone & dropping from air.

D} Agri Drone has ONE BUSINESS MODEL in India which we broke cover 10 years ago with multiple awards & recognition – Rural Agri Graduate Youth Trained to provide farm-gate crop care services at affordable cost to farmer. {Training means not about flying drones! but about precision agriculture}

E} 220 days is average crop spray requirement in an agriculture focused taluks, a serious & dedicated drone operator fly 20 acres a day making 500 Rs an acre = 10,000 Rs / day & around 20 lakh Rs /Yr.

F} Why no one is making? half baked products in a hurry to go to market, majority focus to participate in govt tenders in metros instead of focusing towards rural.

Even after a decade, there is a room for 16 teams in each 4000 taluks to conquer.